Suez Canal Reopening Set to Challenge European Port Capacity

Following the recent ceasefire between Israel and Hamas, Sea-Intelligence has analysed potential impacts on global container shipping should carriers resume transits through the Suez Canal. The analysis does not predict when or if such a shift will occur, as the Houthis have not declared a ceasefire, and carriers did not revert to the Suez route during the previous truce. Instead, the report models the likely operational consequences if services currently routed around Africa were to return via the Suez Canal.

According to the analysis, two main effects would follow a return to the Suez route: the release of vessel capacity currently tied up on longer voyages and a sharp, temporary surge in cargo arrivals into European ports.

The diversion around Africa has lengthened round-trip times for Asia–Europe and Asia–North America East Coast services, requiring roughly four additional vessels per service to maintain schedules. Reverting to the shorter Suez route would free an estimated 2.1 million TEU of nominal capacity, equal to about 6.5% of the global container fleet.

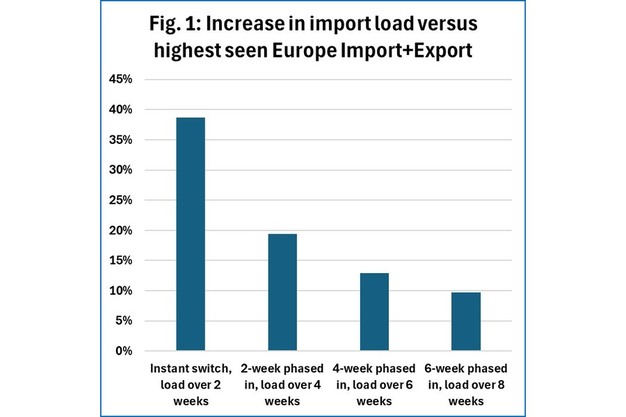

Sea-Intelligence modelled several return scenarios, from an immediate switch by all shipping lines to more gradual phase-ins over two, four, or six weeks. In the case of an instantaneous transition, European ports could see import volumes from Asia double for approximately two weeks, resulting in a 39% increase in total port handling activity compared to the previous all-time peak. Even an eight-week phased resumption would still push volumes around 10% above record levels.

The analysis notes that the earlier peak in March 2025 already caused congestion at several European terminals. A sudden or poorly coordinated return to Suez routing could therefore put additional strain on port operations, storage capacity, and hinterland logistics.

While the timing of any change remains uncertain, the findings suggest that a resumption of Suez Canal transits would reshape global supply chain dynamics, reducing voyage durations but potentially introducing new logistical pressures in Europe.

Source: Article

Author

ATOS-MARelated posts

Digital Tracks: The Impact of Technology on Rail Freight Efficiency

In the fast-paced realm of logistics, the convergence of technology and rail fre

Europe’s Ports Manage Congestion Amid Delayed Vessel Arrivals

North Europe’s container hub ports are coping with the arrival of delayed

The Vertom Patty: Hybrid-Electric Shortsea Vessel

There’s a new Hybrid-Electric Shortsea vessel on the market and her name is Ve