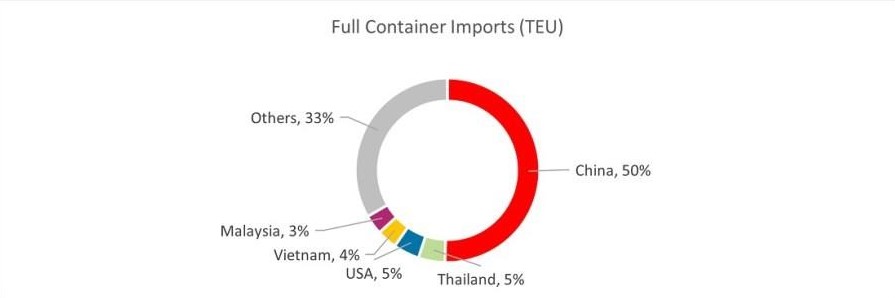

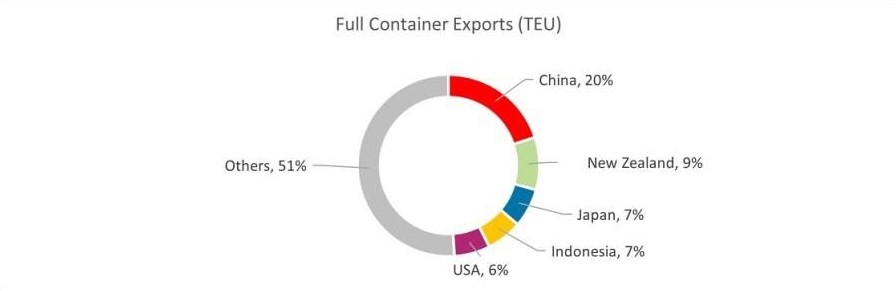

Apart from China, Southeast Asia has emerged as a key trading region in recent years. Most notably, exports to the region have steadily risen from 19% in FY20 to 27% in FY25. In FY25, three of the Port’s top five import sources were Southeast Asian nations – with Indonesia making it into the top ten. These four countries have also consistently been among the Port’s top ten export destinations.

Asia-Pacific

Mega project-driven demand

New services

BYD

Source: Webinar

As businesses grow and expand, they face new challenges and complexities in mana

Two major carriers have announced new Panama Canal surcharges on Asia-US east co