Next Year’s Global Liner Reshuffle: Who Will Win and Lose?

As the dust settles on yesterday’s series of major liner announcements ahead of February’s alliance reshuffles, analysts suggest the winners from the slew of releases are the freight buyers.

THE Alliance will become the Premier Alliance from next February, with Ocean Network Express (ONE), HMM and Yang Ming Marine Transportation as partners, and Mediterranean Shipping Co (MSC) helping plug gaps on Asia-Europe tradelanes.

From the end of January next year, MSC is ditching Maersk in the 2M vessel sharing agreement to largely go it alone, and Germany’s Hapag-Lloyd subsequently exiting THE Alliance to join the Danish carrier in what will be called the Gemini Cooperation.

MSC revealed to clients yesterday the make-up of its standalone services come February next year, detailing how it will operate on five east-west trades with 34 loops.

It was also revealed that as well as teaming with the Asian liner trio on Asia-Europe routes, MSC has signed a three-year cooperation agreement with Israeli carrier ZIM on voyages from Asia to the US east and Gulf coasts.

Existing liner group Ocean Alliance, made up of CMA CGM, COSCO, Evergreen and OOCL, has agreed to continue its vessel-sharing agreement until the end of March 2032.

“This should be good news for shippers using the services offered by the new Premier Alliance,” commented Peter Sand, chief shipping analyst at Xeneta, a freight rate platform.

“Arguably, European customers should get a better offering compared to the current THE Alliance as MSC is a much bigger player with many more ultra large containerships to deploy on Asia to Europe trades,” Sand said.

Agreeing with Sand, Lars Jensen, who heads up container consultancy Vespucci Maritime, commented on LinkedIn: “For shippers it appears that the alliance shake-up is indeed leading to more variety in the terms of network setups offered in the market.”

In related news, yesterday the US Federal Maritime Commission (FMC) in Washington DC approved the creation of the Gemini Cooperation between Maersk and Hapag-Lloyd, but the regulator’s chairman voiced some concern about the new grouping.

Daniel Maffei, the FMC’s chairman, said yesterday he had “questions and concerns” about whether the Gemini Cooperation agreement filed with the FMC has, or will, result in anti-competitive consequences that violate the US Shipping Act.

Current law does not provide the commission with any additional time to further evaluate the proposed agreement and no viable way to stop it from taking effect at this time, Maffei said, revealing that FMC staff will carry out “ongoing rigorous monitoring” of the Gemini Cooperation to ensure that it does not illegally impact US importers, exporters, covered service providers, and consumers.

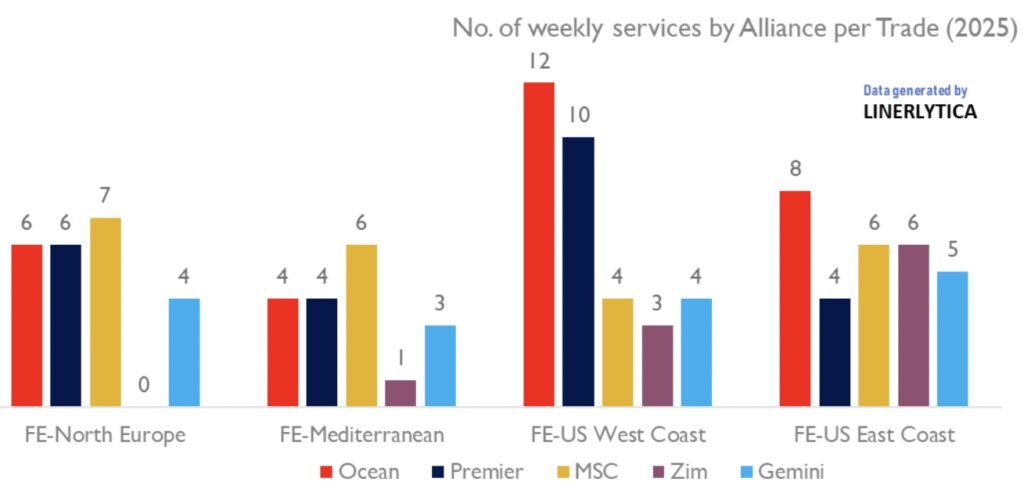

In terms of the number of services headings to the US, Gemini Cooperation is dwarfed by other groups, notably the Ocean Alliance (see chart below).

For their part, Maersk and Hapag-Lloyd today announced that they will share their full network plans next month.

Depending on which network the pair will phase in, the new network consists of either 27 or 29 ocean mainliner services supported by 30 intra-regional shuttle services. The collaboration will comprise of either 300 or 340 vessels with full details expected to be revealed in October.

“We are looking forward to the launch of our completely redesigned network next year, and we are happy to reconfirm that our schedule reliability target remains unchanged irrespective of which network we will phase in. We believe our collaboration will raise the bar for reliability to the benefit of our customers and set a new and very high standard in the industry,” Vincent Clerc, the CEO of Maersk, said today.

The two European liners have repeatedly made the bold claim that they will have an industry-leading schedule reliability above 90% once the new networks are fully phased in.

Source: Article

Stay ahead of the changes brought by the global liner reshuffle and its impact on sea freight operations. Learn more about how to adapt your shipping strategies to navigate this evolving landscape and maintain efficient logistics.

Author

ATOS-MARelated posts

The Evolving Landscape of Road and Rail Freight: Trends and Challenges in 2024

The road and rail freight industry has always been the backbone of global trade,

Strike Disruption Starts: Surge in Air freight Demand Expected

The US dockworker union ILA may only just have confirmed the east and Gulf coast

Yang Ming Chiefs Deny Extra Bonus Amid Doubled Q1 Profits

Yang Ming has denied media reports that its chairman and GM, Cheng Cheng-mount a