Shipping Industry Entering Fragile Growth Phase, Says UNCTAD

Global shipping is entering a period of fragile growth, rising costs and mounting uncertainty, according to The Review of Maritime Transport 2025 released yesterday by UN Trade and Development (UNCTAD).

After firm growth last year, seaborne trade is expected to stall in 2025, with volumes barely rising (+0.5%). Long-distance rerouting caused by geopolitical tensions kept ships busier last year with a record of nearly 6% growth in ton-miles.

Political tensions, new tariffs, shifting trading patterns and reconfigured shipping lanes are reshaping the geography of maritime trade, UNCTAD said.

The result is more rerouting, skipped port calls, longer journeys and ultimately increased costs. Energy shipping is also in transition: Coal and oil volumes are under pressure from decarbonisation efforts, while gas trade continues to expand.

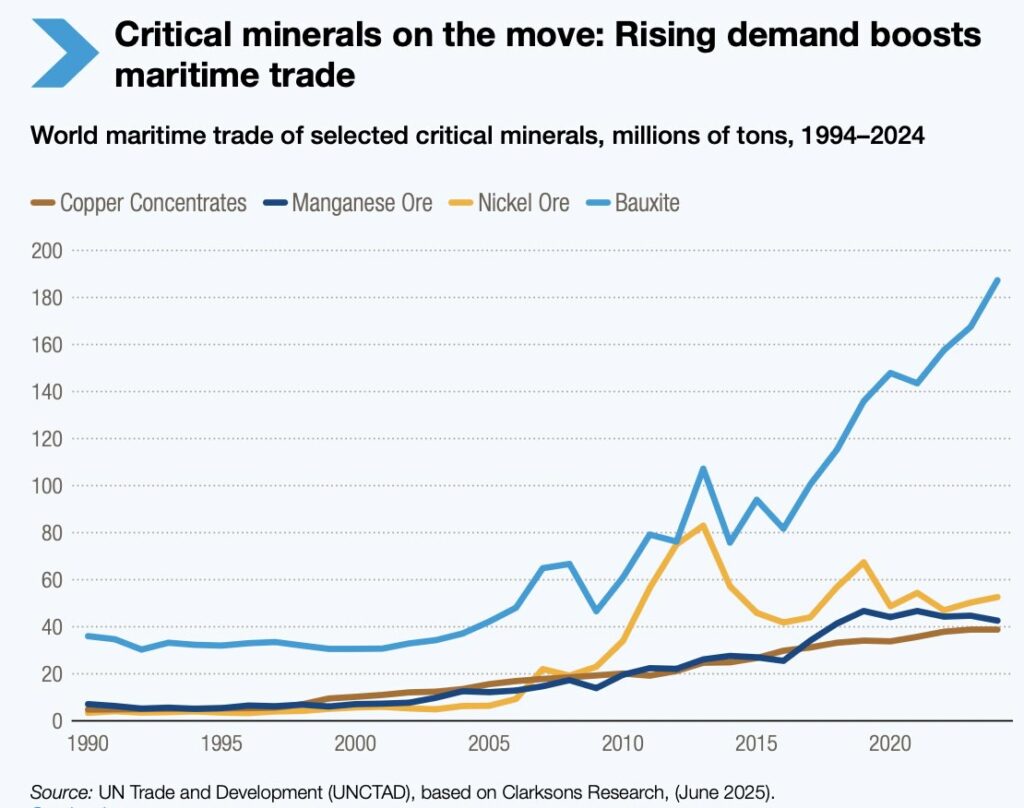

Critical minerals — essential for batteries, renewable energy and the digital economy as a whole — are becoming a new source of tension in global trade, with competition to secure supplies and add value domestically, UNCTAD said, with the volume of these seaborne trades leaping dramatically (see chart below).

Freight rates have become more volatile, UNCTAD said with disruptions such as the 2024 Red Sea crisis driving a surge that year, while ongoing geopolitical tensions in 2025 raise concerns about potential spillovers that could disrupt shipping activity in the Strait of Hormuz.

“Environmental compliance costs, including emissions pricing, are redefining shipping economics,” UNCTAD stated, adding that persistent high transport costs risk hitting developing countries the hardest, particularly small island developing states and least developed countries.

Ports are under strain from disruptions, leading to congestion and longer waiting times with UNCTAD urging governments to implement global commitments on trade facilitation and automation, and expand public–private partnerships in port operations. As digitalisation advances, cybersecurity emerges as a critical priority.

Shipping’s greenhouse gas emissions (GHG) rose by 5% in 2024, UNCTAD data shows. Only 8% of the world fleet’s tonnage is equipped to use alternative fuels, according to UNCTAD and ship recycling rates remain low.

“The transitions ahead – to zero carbon, to digital systems, to new trade routes – must be just transitions,” said UNCTAD secretary-general Rebeca Grynspan. “They must empower, not exclude. They must build resilience, not deepen vulnerability.”

Source: Article

Author

ATOS-MARelated posts

Biofuel Trials Launched To Safeguard The Shipping Industry

As the shipping industry is having more pressure applied to reduce emissions, ne

Reverse Logistics: Enhancing Sustainability through Efficient Product Returns

In today’s consumer-driven economy, product returns have become a common o

Shipping by Air, Land or Sea: The Future of Carbon Neutral

So is it possible that we will see carbon-neutral shipping by air or sea in the